Sure. HDFC AMC’s assets under management (AUM) grew 25% year-on-year in the July-September quarter, but it’s quite something to expect similar growth for the next 10 years.

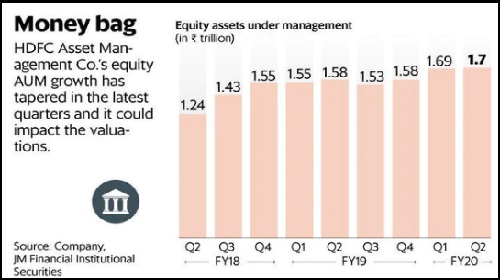

Note inflows to equity mutual funds have been waning. In fact, in the second quarter, equity AUM increased by just about 0.5% sequentially. While HDFC AMC’s shares have dropped about 23% from their highs earlier in the year, valuations are still stretched.

HDFC AMC has been among the most consistent companies in attracting inflows to its funds; it is in the top quartile of inflows. One important factor that tends to drive AUM growth is the returns of equity funds, where HDFC AMC has fallen a bit short lately. But as one analyst notes on condition of anonymity: “HDFC AMC will continue to attract larger inflows due to the brand-pull the fund house enjoys among distributors and investors, even if the performance of its equity funds haven’t been top-notch."

Note that profitability of AMCs gets a boost with higher equity AUMs. Nevertheless, an expansion in operating profits in these past quarters was largely due to savings in upfront commission expenses to distributors. This will likely be affected in the coming quarters once the effect of a lower base begins to kick in from Q4.

Note also that distributor incomes have been coming down, which could take a toll on equity inflows. “Distributor revenues are expected to compress further in FY20, as they bear the brunt of the TER cut. Lower distributor profitability may take its toll on equity MF inflows in the medium term, we feel," said the JM Financial report.

Another factor that could impact the growth of equity AUMs is the rise of passive exchange traded funds. For now, they constitute about 6% of AUM, but globally their share in overall AUM has been rising consistently, which could also play out in the home market.

Despite a stiff correction, the price-earnings multiple of 53 times trailing-12-month earnings of the HDFC AMC stock barely offers much comfort.

" />

HDFC Asset Management Co. (AMC) Ltd’s top-performing equity funds have delivered returns of just about 11% in the past one year. By comparison, the HDFC AMC’s stock returned about 93%, far higher than those of its equity schemes.

Notwithstanding the sluggishness in the markets, investors have their hopes set high with HDFC AMC. A reverse discounted-cash-flow analysis indicates that the AMC’s current valuations imply an enthusiastic 26% annual growth in assets for the next 10 years, notes JM Financial Institutional Securities Ltd in a note to clients.

Sure. HDFC AMC’s assets under management (AUM) grew 25% year-on-year in the July-September quarter, but it’s quite something to expect similar growth for the next 10 years.

Note inflows to equity mutual funds have been waning. In fact, in the second quarter, equity AUM increased by just about 0.5% sequentially. While HDFC AMC’s shares have dropped about 23% from their highs earlier in the year, valuations are still stretched.

HDFC AMC has been among the most consistent companies in attracting inflows to its funds; it is in the top quartile of inflows. One important factor that tends to drive AUM growth is the returns of equity funds, where HDFC AMC has fallen a bit short lately. But as one analyst notes on condition of anonymity: “HDFC AMC will continue to attract larger inflows due to the brand-pull the fund house enjoys among distributors and investors, even if the performance of its equity funds haven’t been top-notch."

Note that profitability of AMCs gets a boost with higher equity AUMs. Nevertheless, an expansion in operating profits in these past quarters was largely due to savings in upfront commission expenses to distributors. This will likely be affected in the coming quarters once the effect of a lower base begins to kick in from Q4.

Note also that distributor incomes have been coming down, which could take a toll on equity inflows. “Distributor revenues are expected to compress further in FY20, as they bear the brunt of the TER cut. Lower distributor profitability may take its toll on equity MF inflows in the medium term, we feel," said the JM Financial report.

Another factor that could impact the growth of equity AUMs is the rise of passive exchange traded funds. For now, they constitute about 6% of AUM, but globally their share in overall AUM has been rising consistently, which could also play out in the home market.

Despite a stiff correction, the price-earnings multiple of 53 times trailing-12-month earnings of the HDFC AMC stock barely offers much comfort.

0 thoughts on “Why HDFC Asset Management shares continue to outclass its equity funds”