At the end of FY19, Trent had 150 Westside stores and 40 Zudio stores.

Analysts expect Zudio to emerge as a big growth driver for Trent, although its current contribution to revenues is comparatively small.

According to Motilal Oswal Financial Services Ltd’s estimates, Zudio will see 70/80/100 store adds in FY20/21/22, taking its total store strength to 290 by FY22. The broker expects Zudio’s revenue to hit ₹1,450 crore by FY22. “Thus, Zudio is expected to contribute 26% to Trent’s overall revenue; contribution toward Ebitda is also expected at similar level," the Motilal analysts said in a report on 22 November. Ebitda is earnings before interest, tax, depreciation and amortization.

The company is adding stores in the Westside format as well. Strong execution on store additions will be a key factor to monitor for the stock, although the sharp appreciation in the share price does suggest that a good share of the optimism is baked into the valuations, capping near-term upsides. Nonetheless, if Trent continues to deliver strong numbers, valuations could well find support.

On the flip side, losses in the hypermarket format have some analysts worried. “Bloated losses in its joint venture (mainly Trent Hypermarket) remains a key concern," said ICICI analysts.

" />

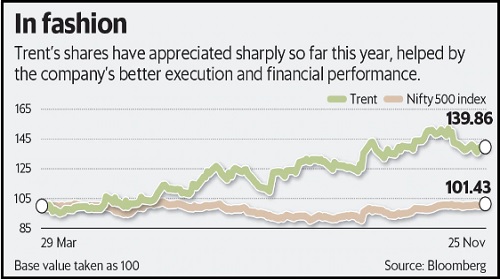

Shares of Trent Ltd have risen nearly 40% this fiscal year. The company is on an expansion mode and at the same time delivering in terms of financial performance. This is helpful, especially at a time when many consumer-oriented firms are feeling the heat from a demand slowdown. Trent primarily operates stores across four concepts— Westside, Zudio, Star and Landmark, with Westside as its flagship chain.

One factor that has helped Trent get the price-conscious Indian consumer’s attention is by making its products available at attractive price points, particularly at Westside and Zudio. In FY20 so far, both these formats have fired on growth.

For the six months ended 30 September, the company’s stand-alone revenue increased by 31% to ₹1,585 crore from a year earlier. Analysts at ICICI Securities Ltd’s retail equity research said in a report on 8 November, “Revenues from the Westside format grew 23% year-on-year, driven by robust like-to-like sales growth of 13% in H1FY20." Like-to-like sales is a parameter that measures growth from organically comparable stores. “Trent’s value fashion business under the ‘Zudio’ brand has seen exceptional ramp-up with revenues growing 2 times in H1FY20," said the broker. However, this is on a relatively smaller base.

At the end of FY19, Trent had 150 Westside stores and 40 Zudio stores.

Analysts expect Zudio to emerge as a big growth driver for Trent, although its current contribution to revenues is comparatively small.

According to Motilal Oswal Financial Services Ltd’s estimates, Zudio will see 70/80/100 store adds in FY20/21/22, taking its total store strength to 290 by FY22. The broker expects Zudio’s revenue to hit ₹1,450 crore by FY22. “Thus, Zudio is expected to contribute 26% to Trent’s overall revenue; contribution toward Ebitda is also expected at similar level," the Motilal analysts said in a report on 22 November. Ebitda is earnings before interest, tax, depreciation and amortization.

The company is adding stores in the Westside format as well. Strong execution on store additions will be a key factor to monitor for the stock, although the sharp appreciation in the share price does suggest that a good share of the optimism is baked into the valuations, capping near-term upsides. Nonetheless, if Trent continues to deliver strong numbers, valuations could well find support.

On the flip side, losses in the hypermarket format have some analysts worried. “Bloated losses in its joint venture (mainly Trent Hypermarket) remains a key concern," said ICICI analysts.

0 thoughts on “Trent stock in vogue managing expansion is key to sustaining valuations”