The Hong Kong share market inclined on Monday, 15 July 2019, extending gains to a fifth day, as risk sentiments underpinned following the closing record of the three major benchmarks in the US on Friday and after growth data from China met expectations. At closing bell, the Hang Seng Index advanced 0.3%, or 83.26 points, to 28,554.88. The Hang Seng China Enterprises Index was up 0.47%, or 50.65 points, to 10,838.99.

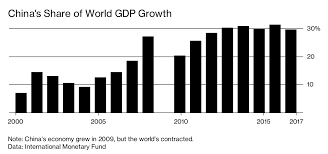

The world's number-two economy expanded 6.2% in second quarter ended June 2019, inline with market expectation, but down from the first quarter's 6.4%, amid weak domestic and external demand and a damaging trade war with the United States. The decline in GDP growth reinforced expectations that Beijing needs to announce more support measures to boost consumption and investment and restore business confidence

Tariff hikes by President Donald Trump have battered Chinese as well as U.S. exporters, and Chinese leaders have increased spending and loosened controls on bank lending to keep growth within this year's range of 6% to 6.5%, down from the 6.6% growth China put up in 2018.

Also, other Chinese data suggested that manufacturing, a key indicator for growth in the country, perked up, with industrial output growing 6.3 per cent in June compared with 5 per cent in May. Fixed-asset investment also picked up, rising 5.8% on-year in January-June, from 5.6% in January-May. Retail sales growth also improved, grew 9.8% on-year in June, up from 8.6% in May, hinting that domestic consumption remains robust.

Blue chips were mixed. HSBC (00005) edged down 0.3% to HK$65.05. HKEX (00388) dipped 1.2% to HK$271.8. Tencent (00700) gained 1.7% to HK$361. China Mobile (00941) added 0.6% to HK$70.35. AIA (01299) put on 0.4% to HK$85.75. China Resources Beer (00291) rose 2.4% to HK$36.65. Tsingtao Brewery (00168) climbed 1.1% to HK$48.

Pharmaceutical counters were higher after China's National Healthcare Security Administration informed drug makers of the new rules regarding how the first round GPO (Group Purchasing Organization) would be implemented nationwide. CSPC Pharmaceutical (01093) soared 7% to HK$13.46, becoming the best blue-chip winner. Sino Biopharmaceutical (01177) surged 5.5% to HK$8.99. Sinopharm (01099) jumped 1.9% to HK$29.2. Luye Pharma (02186) rose 4.1% to HK$5.86. Fosun Pharmaceutical (02196) shot up 4% to HK$24.8. Guangzhou Baiyunshan Pharmaceutical (00874) added 2% to HK$35.75

0 thoughts on “Hong Kong Market gains on China economic data”