Since FSA volumes account for a large share of Coal India’s volumes, better realizations helped partially compensate for the overall muted show on the volume front.

On the other hand, realizations from coal sold through the e-auction route, which typically follow global coal prices, declined by about 20% year-on-year. The upshot: the coal miner’s consolidated reported revenue declined by about 7% to ₹20,383 crore. Net profit stood at ₹3,524 crore, representing a 14% growth from the previous year.

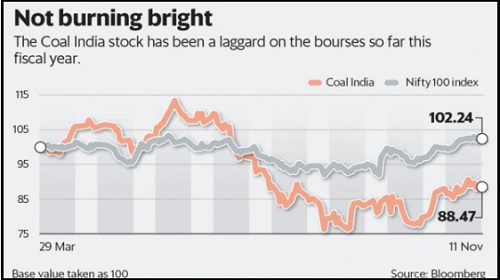

The September quarter results may well put some fire into the Coal India stock, which is feeling rather unloved at the moment. So far this fiscal year, shares of the country’s largest coal producer have fallen by about 12% on the National Stock Exchange. This is at a time when the broader Nifty 100 index has risen by 2.2% during the same time frame.

Investors worry about government stake sales, say analysts. Plus, production and offtake over April-October 2019 have declined by 8.5% and 7% year-on-year, respectively. Growth revival in volumes along with better volume mix remains crucial for the Coal India stock. On the bright side, this year may turn out to be better on the dividend front.

“Considering H1FY20 capex of about ₹2,000 crore, we believe bulk of the spending will be in H2FY20. In our view, while capex towards equipment is likely to be incurred, the one for land acquisition may be slightly delayed. On the other hand, cash balance of ₹37,000 crore will enable Coal India to give healthy dividend in line with recent past at ₹20 per share," pointed out analysts at Edelweiss.

" />

Nobody expected the moon from Coal India Ltd’s September quarter results. A key reason was that its production was hit last quarter by extended monsoon in certain regions, besides labour strikes. Production and offtake (or sales volume) dropped 13% and 11% year-on-year, respectively.

Even as this was expected to cast a shadow on the coal miner’s performance, higher realizations from coal sold through the fuel supply agreement (FSA) route helped the company’s profit beat expectations. Plus, depreciation costs declined marginally and tax outgo was substantially lower, boosting net profit.

FSA realizations have increased by nearly 10% over the same period last year and 5% compared to the June quarter. FSA realization at ₹1,438 per tonne, is the highest-ever on sharpening focus on non-power consumers, said analysts at Edelweiss Securities Ltd in a report on 11 November. “FSA realisation is expected to sustain at the current level owing to change in product mix," they added.

Since FSA volumes account for a large share of Coal India’s volumes, better realizations helped partially compensate for the overall muted show on the volume front.

On the other hand, realizations from coal sold through the e-auction route, which typically follow global coal prices, declined by about 20% year-on-year. The upshot: the coal miner’s consolidated reported revenue declined by about 7% to ₹20,383 crore. Net profit stood at ₹3,524 crore, representing a 14% growth from the previous year.

The September quarter results may well put some fire into the Coal India stock, which is feeling rather unloved at the moment. So far this fiscal year, shares of the country’s largest coal producer have fallen by about 12% on the National Stock Exchange. This is at a time when the broader Nifty 100 index has risen by 2.2% during the same time frame.

Investors worry about government stake sales, say analysts. Plus, production and offtake over April-October 2019 have declined by 8.5% and 7% year-on-year, respectively. Growth revival in volumes along with better volume mix remains crucial for the Coal India stock. On the bright side, this year may turn out to be better on the dividend front.

“Considering H1FY20 capex of about ₹2,000 crore, we believe bulk of the spending will be in H2FY20. In our view, while capex towards equipment is likely to be incurred, the one for land acquisition may be slightly delayed. On the other hand, cash balance of ₹37,000 crore will enable Coal India to give healthy dividend in line with recent past at ₹20 per share," pointed out analysts at Edelweiss.

0 thoughts on “Higher realizations at Coal India from FSA deals spark the fire in September quarter”