As a result of the upbeat revenue performance, Glenmark’s Ebitda margins outpaced expectations. Glenmark delivered about 16% margin in Q2 against an expectation of about 14%. This despite higher expenses due to rising staff costs. Research and development costs were flat, though. Ebitda is earnings before, interest, tax, depreciation and amortisation.

Net debt, which has increased in the first half, remains a concern. “However, we are yet to see any net debt reduction (net debt increased by US$10mn in 1HFY20) from the core business (capex at US$100mn+ and R&D at US$185 mn - both continue to be high). The management expects debt reduction to be achieved from the divestment of non-core assets where they expect some closure of deal over the next two quarters," said Credit Suisse India in a note to clients.

Nevertheless, the company is looking at some deals and capital infusion into some of its businesses to reduce debt. Analysts expect net debt to shrink about $3 bln by the end of this year. If the debt reduction is on track, it can help strengthen recovery.

" />

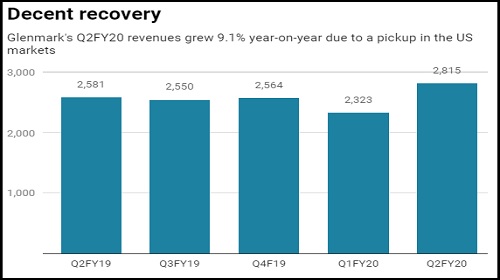

After a slow start to the financial year, Glenmark Pharmaceuticals Ltd has been recuperating well. The firm delivered a strong dose of quarterly performance that was ahead of Street’s expectations. Growth in two of its key markets, India and the US, pushed revenues and operating performance higher. Little surprise that its shares are hovering close to 52-week lows, gaining 8.5% on Monday.

Glenmark’s domestic business grew about 15% year-on-year in Q2FY20. Revenue grew as some key therapies gained market share, a sign of recovery. The US business grew 12-13% more than what the Street had expected. A ramp-up in the distribution of some of its new launches drove US markets.

Given that the US market is facing high competitive pricing pressure, this is a sign of recovery. Further, there are indications the US market will achieve mid-single-digit growth in the second half. The company expects approval for two products in the US, a key to sustain growth. Another good thing is that the dermatology segment has seen much lower price erosion. Additionally, rest of the world business is also gaining momentum.

As a result of the upbeat revenue performance, Glenmark’s Ebitda margins outpaced expectations. Glenmark delivered about 16% margin in Q2 against an expectation of about 14%. This despite higher expenses due to rising staff costs. Research and development costs were flat, though. Ebitda is earnings before, interest, tax, depreciation and amortisation.

Net debt, which has increased in the first half, remains a concern. “However, we are yet to see any net debt reduction (net debt increased by US$10mn in 1HFY20) from the core business (capex at US$100mn+ and R&D at US$185 mn - both continue to be high). The management expects debt reduction to be achieved from the divestment of non-core assets where they expect some closure of deal over the next two quarters," said Credit Suisse India in a note to clients.

Nevertheless, the company is looking at some deals and capital infusion into some of its businesses to reduce debt. Analysts expect net debt to shrink about $3 bln by the end of this year. If the debt reduction is on track, it can help strengthen recovery.

0 thoughts on “Glenmark s decent Q2 numbers may just signal a reversal in its course”