In some of its categories, Dabur is making inroads and gaining market share. That is a good sign as overall industry sales in some categories have contracted.

In oral care, Dabur gained market share and grew nearly 5%, while the category saw a negative growth rate.

The company also reported a decent 14.4% growth in health supplements. In juices, however, growth has been sluggish even as carbonated drinks seems to be gaining more track.

At the post earnings conference call, the management reiterated its earnings growth guidance of mid to high single-digit, which seems fair considering the slow growth in GDP.

However, working capital levels are getting stretched. Dabur has been extending credit selectively to some distributors due to tight liquidity conditions. In some cases, credit terms have risen from about six days to even 15-20 days.

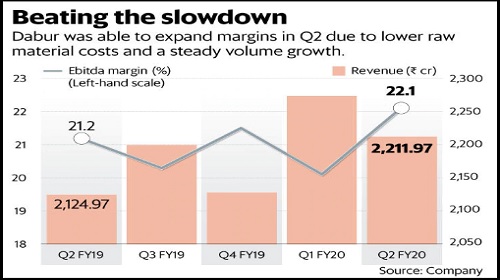

But material costs were significantly soft this quarter. Besides, a better product-mix coupled with improving operating leverage due to higher volumes led to an expansion in Q2 Ebitda margin to 22.1% from 21.2% in the year ago quarter.

As a result, net profit grew 7%. This is despite a one-time impairment cost in Q2.

Even then, the stock seems to be pricing in much higher growth rates in the future. At about 57 times trailing 12-month earnings, the stock is quite expensive, considering that adjusted net profit growth is in the mid-teens.

Also, any disruption in volume growth in the coming quarters could squeeze the growth rate.

" />

Despite weak demand conditions, Dabur Ltd’s Q2 volume growth surpassed market expectations. That optimism is being reflected in its shares, which surged 4.9% immediately on the results being announced.

In Q2 FY20, Dabur’s FMCG divisions saw about 4.8% volume growth, year-on-year. Excluding its foods business, volume growth was about 7.4%. Besides, the international business was quite steady, at about 3.2% in constant currency.

As a result, Dabur’s Q2 revenue grew 4.1% year-on-year, which is considered quite decent given the general anaemic economic growth. Rural growth was about 6% twice as fast as urban, which shows the company’s rural foray seems to be paying off.

In some of its categories, Dabur is making inroads and gaining market share. That is a good sign as overall industry sales in some categories have contracted.

In oral care, Dabur gained market share and grew nearly 5%, while the category saw a negative growth rate.

The company also reported a decent 14.4% growth in health supplements. In juices, however, growth has been sluggish even as carbonated drinks seems to be gaining more track.

At the post earnings conference call, the management reiterated its earnings growth guidance of mid to high single-digit, which seems fair considering the slow growth in GDP.

However, working capital levels are getting stretched. Dabur has been extending credit selectively to some distributors due to tight liquidity conditions. In some cases, credit terms have risen from about six days to even 15-20 days.

But material costs were significantly soft this quarter. Besides, a better product-mix coupled with improving operating leverage due to higher volumes led to an expansion in Q2 Ebitda margin to 22.1% from 21.2% in the year ago quarter.

As a result, net profit grew 7%. This is despite a one-time impairment cost in Q2.

Even then, the stock seems to be pricing in much higher growth rates in the future. At about 57 times trailing 12-month earnings, the stock is quite expensive, considering that adjusted net profit growth is in the mid-teens.

Also, any disruption in volume growth in the coming quarters could squeeze the growth rate.

0 thoughts on “Despite weak demand Dabur churns out decent results in Q2”